IN THE SECURITIES APPELLATE TRIBUNAL MUMBAI

Appeal No. 122 of 2006 Date of decision : 13-04-2007

M/s. Jayantilal Khandwala & Sons Pvt. Ltd. …… Appellant

Versus

The Securities and Exchange Board of India …… Respondent

Mr.Gaurav Joshi, Advocate for the appellant.

Mr Kumar Desai, Advocate for the respondent.

Coram : Justice N.K. Sodhi, Presiding Officer

R.N. Bhardwaj, Member

Per : Justice N.K. Sodhi, Presiding Officer

This appeal under section 15T of the Securities and Exchange Board of India Act, 1992 is directed against the order dated 7th September, 2006 passed by the Whole Time Member of the Securities and Exchange Board of India (hereinafter called the Board) imposing the penalty of suspension of certificate of registration of the appellant as a stock broker for a period of one month. Facts giving rise to this appeal lie in a narrow compass and these may first be stated.

The appellant is a stock broker registered with the Board. It was alleged that the appellant dealt in the scrip of DSQ Software Limited (for short the DSQ) on behalf of its client DSQ Holdings Limited and made purchases and sales in large quantities which did not result in deliveries since the transactions were squared off within the same settlement period and this, according to the Board, was done with a view to create artificial volumes in the scrip.

It was also alleged that the appellant had executed trades which matched or synchronized in terms of time, price, order quantity and in other particulars and since the buying client and the selling client were the same, the transactions were fictitious. The Board found that these transactions were highly irregular and interfered with the normal price discovery process of the exchange. After the investigations were completed, the Board appointed an inquiry officer who issued a show cause notice to the appellant to which a detailed reply was filed denying all the allegations. On a consideration of the material collected by the inquiry officer he found both the charges established against the appellant and accordingly recommended to the Board that its certificate of registration be suspended for four months. On receipt of the inquiry report, the Board issued a notice dated November 9, 2004 calling upon the appellant to show cause why action should not be taken against it as recommended by the inquiry officer. The appellant filed its reply and after considering the same and affording a personal hearing to the appellant the Board concurred with the findings of the inquiry officer and came to the conclusion that the broker did not exercise due care and caution and that it did not act with due diligence while trading in the scrip of DSQ on behalf of its client. The Board found that the appellant had violated Regulation 4B of the Securities and Exchange Board of India (Prohibition of Fraudulent and Unfair Trade Practices relating to the Securities Market) Regulations, 1995 and also the code of conduct prescribed for the stock brokers. Accordingly, the certificate of registration of the appellant was suspended for a period of one month. Hence this appeal.

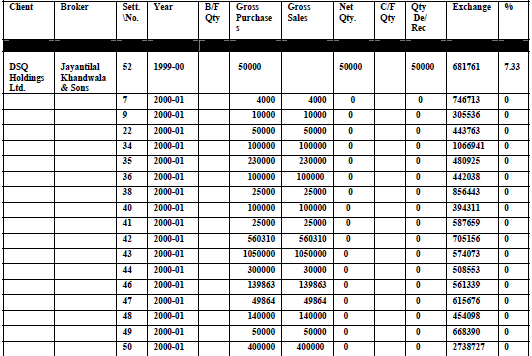

We have heard the learned counsel for the parties. The first charge levelled against the appellant pertains to the creation of false volumes in the scrip of DSQ while trading on behalf of its client. It is not in dispute that the appellant had executed trades on behalf of DSQ Holdings Limited. This company and DSQ are associate companies and this fact is not disputed by either of the parties. The Board while holding that this charge stood established has placed reliance on the following chart depicting the trades executed by the appellant as a broker. The said chart is reproduced hereunder for facility of reference

It is clear from the aforesaid chart that during the period of settlement no.52 the appellant had purchased 50,000 shares of DSQ and sold an equal number of shares and the trade was settled both in terms of delivery as also in terms of payment. This is not disputed. Thereafter the appellant has been purchasing and selling the shares as per the instructions of its client namely DSQ Holdings Limited and all the transactions had been squared off during the respective settlement periods without effecting any delivery. Since most of the trades were settled without delivery one can say that those were executed with a view to speculate in the market. The Board has found that the volumes of the trades were high and has, therefore, jumped to the conclusion that the trades were meant to create artificial volumes. We can not agree with this finding. The inference drawn can not be justified because the Board has not taken into consideration the total volumes of the scrip traded on the Bombay Stock Exchange (for short the BSE) and other stock exchanges including the National Stock Exchange.

The appellant has placed figures of BSE before us which could not be disputed on behalf of the Board. Even when we look at those figures contained in the chart which is Ex. I on the record we find that during the course of settlement no.34 one lac shares were purchased by the appellant and an equal number of shares were sold. The total gross volumes of the trades executed by the appellant during this settlement comes to two lacs.

On the other hand, the total gross volumes of the scrip on the BSE is 2,32,35,346. In other words, the appellant traded in 2 lacs shares as compared to such large volumes traded by others only on the BSE. The total percentage of the volumes traded by the appellant on the BSE comes to .0086 of the total volumes of the trades on BSE during the said settlement (settlement no.34). Can it be said that the appellant as a broker was trying to create false volumes in the market. The answer has to be in the negative. The percentage of trades executed by the appellant is so small that it could possibly have no effect on the market. We have taken settlement no. 34 as an instance. Same is the position in regard to other settlement periods as well. We have not taken note of the trades executed on other exchanges including the National Stock Exchange. If the appellant were to really create false volumes its share of trading in the scrip on the BSE and other exchanges out of the total traded volumes would have been much more and the percentage would have been much higher. In this view of the matter we have no hesitation in reversing the finding recorded by the Board on the first charge.

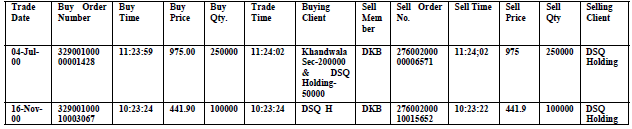

Now coming to the second charge which relates to synchronized trades executed by the appellant. The Board has relied upon the following two trades executed by the appellant on July 4, 2000 and November 16, 2000-

It is not in dispute that the buyer and the seller in both these transactions was DSQ Holdings Limited but this fact was not known to the appellant as a broker at the time when the trades were executed. In a system of screenbased-trading that is resorted to in the stock exchanges it is not possible for either of the brokers to know the counter party at the time of execution of the trade. This fact can be discovered only by the stock exchange after the completion of the trade and that, too, if an inquiry is made. A unique feature of the screen-based-trading system is the anonymity of the buyer and the seller.

It cannot, therefore, be said that the apellant while executing the trades on July 4, 2000 or on November 16, 2000 knew the counter party. The stand taken by the appellant is that it had executed these two trades on the instructions of its client namely DSQ Holdings Limited. There is no material on the record to show that the appellant at the time of executing the aforesaid trades knew that DSQ Holdings Limited was also the seller through another broker namely Dresdner Kleinwort Benson Securities (India) Limited (DKB). The learned counsel for the respondent, however, referred to the statement made by R.Ramachandran, a representative of DKB to contend that Mr. Jatin Khandwala, a director of the appellant contacted DKB to buy the shares and the latter sold those through the appellant. It is true that Mr. Ramachandran made such a statement during the course of the investigations and when this statement was put to the appellant it denied the same and it appears that in view of this denial the inquiry officer did not place any reliance on the statement of Mr. Ramachandran. Even the Board has not placed any reliance on this statement in the impugned order obviously because it remained unsubstantiated as it is a word of one against the other. We can not take note of that statement at this stage and hold on that basis that the appellant knew that the trades were to be synchronized. However, when we look at the trades we find that the buy orders and the sell orders were placed almost simultaneously for the same quantity and the price was also matching. Normally, such large quantity would not match on the system but there could be a co-incidence. Taking note of the fact that these were two isolated trades executed by the appellant after a gap of more than four months and that such trades were not executed repeatedly we are inclined to give the benefit of doubt to the appellant. The trades, no doubt, raise some suspicion but suspicion, howsoever strong cannot take the place of proof. The penalty of suspension of certificate of registration of a stock broker has a severe and adverse effect on the right of the appellant to carry

on its business and should be awarded only when there is on record strong and incontrovertible evidence of its having played a role in synchronizing the trades. As already observed, this is a case where the appellant deserves to be given the benefit of doubt. This being so, the second charge must also fail.

In the result, the appeal is allowed and the impugned order set aside with no order as to the costs.

Justice N.K. Sodhi Presiding Officer R.N. Bhardwaj Member

bbn